First, as ever, there is the overarching effort to try to get the poor to uncritically accept the tools the rich have used to acquire their great wealth and become powerful. Finance is one of these tools…

A second rationale behind financial inclusion is about finding some new popular goal that will help to keep the bloated and largely discredited microfinance industry alive.

Milford Bateman

“Let's not kid ourselves that financial inclusion will help the poor” (The Guardian, 2012)

Earlier, I wrote on how the growing migrant remittance money stream is being nudged into becoming part of the larger financial system, something that is known as “Financialization of Remittances” (FOR). FOR fits under the umbrella of “Financial Inclusion”.

In 2021, Sub Saharan Africa:

Given Financial Inclusion is the big daddy of FOR, you would think there are perhaps other tentacles of Financial Inclusion that could explain this largess, but if we just dig a little deeper…

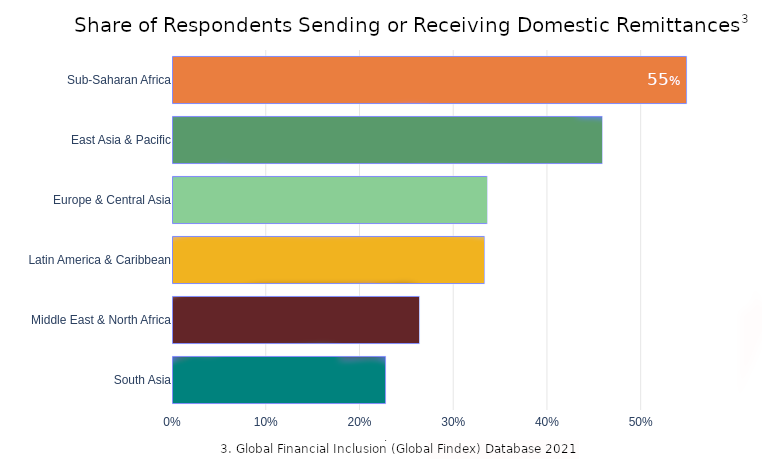

We find that according to the Global Financial Inclusion (Global Findex) Database 2021 (covering around 128,000 people in 120 countries), 55% of those surveyed in Sub Saharan Africa had sent or received domestic remittances in one form or the other, the highest proportion anywhere (excluding high income nations).

The volume of domestic remittance transfers approximates the openness (and capability) to use financial channels to route money. And given the increasing financialization of everything, it seems to be high enough for the priests of Wetiko to get their tongues wagging again.